Limit Increase Get Your Dream Limit | Just Fill in the Simple Form Below: Understanding Credit Limit Increases

When it comes to credit cards, one of the key factors that can significantly impact your purchasing power is the limit increase get your dream limit | just fill in the simple form below. Credit card limits are essential for managing your finances, and many consumers are looking for ways to increase their limits to meet their evolving financial needs. Whether you’re looking to make large purchases, reduce your credit utilization rate, or simply have more flexibility in your spending, a credit limit increase can be a game changer. This article will explore everything you need to know about increasing your credit limit, how to request a limit increase, and how to successfully achieve your dream credit limit by following a simple process.

Table of Contents

Why Do You Need a Credit Limit Increase?

Before delving into the process of requesting a credit limit increase, it’s important to understand the benefits that come with a higher limit. A credit limit increase can open up several advantages, including:

- Improved Credit Score: One of the most immediate benefits of a higher credit limit is that it can improve your credit score by lowering your credit utilization ratio. The credit utilization ratio is the percentage of your available credit that you are using. By increasing your limit, you can keep your spending the same but reduce your utilization rate.

- Increased Purchasing Power: A higher limit allows you to make larger purchases without worrying about maxing out your credit card. This is especially useful for emergencies or when making big-ticket purchases.

- Better Financial Flexibility: With a higher limit, you have more financial flexibility to navigate different situations. Whether it’s covering a surprise expense or taking advantage of rewards programs, a higher limit can give you more room to maneuver.

- More Favorable Terms: Credit card issuers may offer better terms, such as lower interest rates or higher rewards, to customers who have higher credit limits. This can lead to significant savings and enhanced benefits.

- Debt Consolidation: A higher credit limit can also help you consolidate debt by using your available credit to pay off high-interest loans or balances on other credit cards.

How to Request a Limit Increase: Limit Increase Get Your Dream Limit | Just Fill in the Simple Form Below

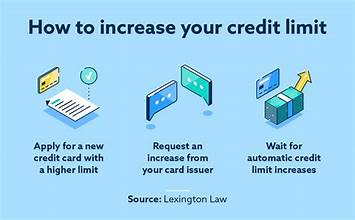

If you want to limit increase get your dream limit | just fill in the simple form below, the first step is to understand how to request this increase from your credit card issuer. Here’s a step-by-step guide:

- Review Your Current Credit Situation: Before requesting a limit increase, it’s essential to review your current credit utilization rate, payment history, and overall financial standing. Credit card issuers are more likely to approve a limit increase if you have a good track record of on-time payments and responsible credit use.

- Ensure Your Credit Score Is in Good Shape: Your credit score plays a crucial role in the likelihood of getting your limit increase request approved. A higher credit score signals to your issuer that you are a responsible borrower. Ensure that your credit score is in good standing before requesting an increase.

- Check for Eligibility: Some credit card issuers have specific eligibility criteria for requesting a limit increase. For example, they may require that you’ve had the card for a certain period (usually 6 to 12 months), have a consistent payment history, and have no significant increases in debt.

- Requesting the Limit Increase: Once you’re ready to make the request, the next step is to fill out the form that your credit card issuer provides. This is where the process of limit increase get your dream limit | just fill in the simple form below comes into play. Many credit card companies have online forms where you can easily submit your request. Some may require you to call customer service or use their mobile app. Be prepared to provide information like your income, monthly expenses, and the reason for requesting the increase.

- Provide Supporting Documentation: In some cases, your issuer may ask for supporting documentation to verify your income or other financial details. This is especially true if you are requesting a substantial increase in your limit. Have your documents ready to avoid delays in processing your request.

- Wait for Approval: Once you’ve submitted your request, the issuer will review your application and financial information. You may receive an immediate decision, or it could take a few business days for them to process your request. If your request is approved, your new limit will be reflected on your account.

Factors That Influence Your Credit Limit Increase

Several factors can impact whether or not your credit limit increase request is approved. limit increase get your dream limit | just fill in the simple form below These factors include:

- Income Level: One of the most important factors that credit card issuers consider when reviewing a limit increase request is your income. A higher income indicates that you have the financial capacity to handle a higher limit.

- Credit Score: Your credit score plays a significant role in the approval process. The higher your score, the more likely it is that your issuer will approve your request. A score above 700 is generally considered good, but issuers may be willing to work with lower scores, especially if you have a history of on-time payments.

- Payment History: Your payment history is another crucial factor. Issuers will look at whether you’ve made timely payments in the past. If you have a history of late payments or missed payments, your chances of approval may decrease.

- Credit Utilization: If you’re already using a high percentage of your available credit, it may indicate to issuers that you’re overextended financially. This could make them less likely to approve your limit increase. Lowering your credit utilization ratio before applying for a limit increase can improve your chances.

- Time with Issuer: The length of time you’ve been a customer with your current credit card issuer can also affect your request. If you’ve had the card for a long time and have used it responsibly, issuers may be more inclined to approve a higher limit.

- Recent Credit Applications: If you’ve recently applied for other credit cards or loans, your issuer may be hesitant to approve your request. Frequent credit inquiries in a short period can be a red flag for issuers.

The Impact of a Credit Limit Increase on Your Credit Score

As previously mentioned, a credit limit increase can have a positive impact on your credit score. However, it’s important to understand how this works. The key to improving your credit score with a higher limit is maintaining a low credit utilization ratio.

- Credit Utilization Ratio: This is the ratio of your credit card balances to your credit limits. Ideally, you should aim to keep your utilization ratio below 30%. For example, if your limit is $10,000, it’s recommended that you do not carry a balance of more than $3,000. Increasing your credit limit can help you achieve a lower utilization ratio, which in turn can boost your score.

- Hard Inquiry: When you request a credit limit increase, the issuer may perform a hard inquiry on your credit report. While a hard inquiry can cause a small, temporary dip in your score, the overall effect of having a higher credit limit is typically positive.

- Long-Term Impact: Over time, if you continue to use your higher credit limit responsibly, it can have a lasting positive effect on your credit score. A higher limit with low utilization signals to lenders that you are a responsible borrower, which can improve your creditworthiness.

Common Mistakes to Avoid When Requesting a Limit Increase

While requesting a credit limit increase is a relatively simple process, there are a few common mistakes that you should avoid to increase your chances of success. limit increase get your dream limit | just fill in the simple form below These include:

- Requesting Too Large of an Increase: If you ask for a credit limit that is significantly higher than your current limit, the issuer may view this as a risky request. Instead, request a moderate increase based on your current financial situation.

- Not Reviewing Your Credit Report: Before requesting a limit increase, it’s essential to review your credit report to ensure there are no errors or issues that could negatively affect your application. Address any discrepancies before proceeding.

- Not Considering the Impact on Your Credit Score: While a credit limit increase can improve your score in the long run, it’s essential to understand that a hard inquiry may cause a short-term dip. If you’re planning to apply for a major loan (like a mortgage), consider the timing of your limit increase request.

- Failing to Monitor Your Spending: A higher credit limit can be tempting, but it’s crucial to avoid overspending just because you have more available credit. Keep your spending in check and maintain a low credit utilization ratio to avoid falling into debt.

Also read Craigscottcapital Financeville: The Future of Investment and Financial Services

Conclusion: Limit Increase Get Your Dream Limit | Just Fill in the Simple Form Below

Increasing your credit limit is a smart way to boost your financial flexibility, improve your credit score, and provide yourself with more room to make larger purchases. By following the simple process of limit increase get your dream limit | just fill in the simple form below, you can quickly access a higher limit and enjoy all the benefits it brings. Just remember to use your new limit responsibly and continue to monitor your credit health to ensure long-term financial success.

By carefully evaluating your credit situation, understanding the factors that affect your approval, and avoiding common mistakes, you can easily achieve your dream credit limit. The process is simple, and with the right approach, you’ll be able to unlock the financial freedom that comes with a higher credit limit.